loans calculator

our offer

this credit implies your legal responsibility and must be repaid. Verify your repayment capacity before signing the credit contract.

the amount shown is indicative and does not represent a contractual commitment by maib

about

Sometimes, in the most unexpected moment, you are put in the situation of finding urgent solutions. Whether the refrigerator has broken down, the car needs repair or other unforeseen expenses have arisen, maib always supports you and offers you the right financing, which helps you solve any financial issue quickly, easily and affordably.

Why choose maib consumer loan?

- we offer you a fixed interest rate, and the conditions will remain unchanged throughout the contract;

- we will make sure that the amount you reimburse monthly does not affect your budget for personal or family needs;

- you will know the effective annual interest rate (EAR) from the beginning. This is the final percentage that forms the cost of the monthly instalments.

More accessible, simple and adapted to your needs. It is now very easy to receive the required amount:

- fill-in the online application in 3 minutes (ID info, income, phone number);

- we approve your loan in about 30 minutes (you will receive the approval by phone call);

- you receive the money on the card 3 minutes after signing the contract.

You can also choose to visit us at maib. To save time, follow these steps:

- download and access the Earlyone application;

- select the city, branch, the service you need, the date and time of the visit;

- you will receive the electronic ticket with a special code;

- enter the special code at the terminal in the branch and you will receive the electronic ticket for the requested banking service;

- at the scheduled time you will be consulted by a maib specialist.

The loan, granted by the bank, is a banking product. The amount contracted and the repayment term are individually negotiated and agreed between the parties. A fixed interest rate of 10.20% p.a., is applied to the consumer expresso loyalty loan, offered to individuals. The Annual Percentage Rate (APR) and the Total Cost of Credit vary depending on the amount and the repayment term of the loan. Example: Loan amount 50 000 MDL, loan term 60 months, fixed interest rate of 10.20% p.a., Total amount payable will be 63 971.58 MDL, divided into 60 monthly instalments of 1066.37 MDL, APR 10.69%.

The loan carries legal liability and must be repaid following the conditions agreed in the loan agreement. Check your ability to pay before signing the loan agreement.

requirements

Apply for the consumer loan if you are between 20 and 70 years old and meet one of the following requirements:

- have a monthly salary or a confirmed income;

- or you receive international money transfers;

- or you have a positive credit history;

- you have a real estate asset, if the amount exceeds 200,000 lei.

deals

The espresso credit is offered without collateral and without justifying the use of the borrowed amount. You receive your card with the amount of the loan immediately.

You receive your salary on a maib card:

- up to 350,000 MDL;

- for a period of up to 60 months.

For a loan of 50 thousand MDL, for 5 years, you will pay approximately 1,066 MDL, with an EAR of 10.69%.

You receive your salary on a card issued by another bank or in cash:

- up to 350,000 MDL;

- for a period of up to 60 months.

For a loan of 50 thousand MDL, for 5 years, you will pay approximately 1.090 MDL per month, with an EAR of 11.69%.

You receive your salary on a card issued by another bank or in cash and have a positive credit history:

- up to 350,000 MDL;

- for a period of up to 60 months.

For a loan of 50 thousand MDL, for 5 years, you will pay approximately 1.066 MDL per month, with an EAR of 10.69%

The conditions are much more attractive for maib customers. Would you like to benefit from them too?

Apply for a gama universal card from gama.maib.md, transfer your salary to it for 6 consecutive months via the maibank mobile app, and you will get the best offer.

Does your income come from sources other than your salary, and are you think about getting a loan? Because we understand you, we have created more credit opportunities based on trust. Now you can get a loan tailored to your needs because you’ve previously benefited from other loans and paid the instalments on time

You have a positive credit history:

- up to 40,000 MDL;

- for a period of up to 60 months.

For a loan of 20 thousand MDL, for 5 years, you will pay approximately 616 MDL per month, with an EAR of 31.38%.

If your loved ones help you and transfer money from abroad, you can get a loan designed especially for you.

You receive international money transfers:

- up to 100,000 MDL;

- for 5 years;

For a loan of 25 thousand MDL, for 5 years, you will pay approximately 770 MDL per month, with an EAR of 31.38%.

The money must be received via money transfer systems (WU, Unistream, etc.) or SWIFT and transferred to a maib account. To receive a loan, you must have made at least 3 transfers via maib or t2c.maib.md in different months in the last 6 months of at least 200 EUR or the equivalent in another currency, including a mandatory transfer in the last 31 calendar days.

For more information, call the Contact Center at 1313.

Choose the espresso consumer loan from maib, you will surely like it!

required documents

It’s simple – all you need is an ID card.

The bank reserves the right to request additional documents regarding your income in order to meet the prudential requirements specific to banking.

frequent questions

There are 5 ways to pay the monthly instalments:

- through the maibank mobile application;

- through internet banking;

- at Cash-In ATMs;

- at self-service terminals;

- in any branch of the bank.

Yes, the money must be received through money transfer systems (Western Union, Unistream, etc.) or SWIFT. To receive a loan you must benefit from at least 3 transfers through maib or www.t2c.maib.md during different months, in the last 6 months, of at least 200 euros or the equivalent in another currency.

You can apply online, completing the application in just 2-3 minutes.

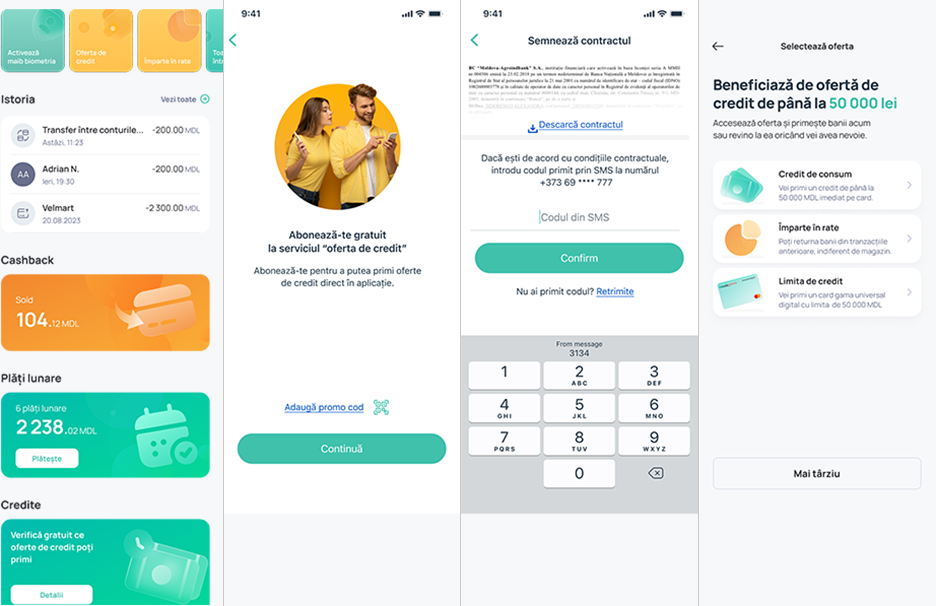

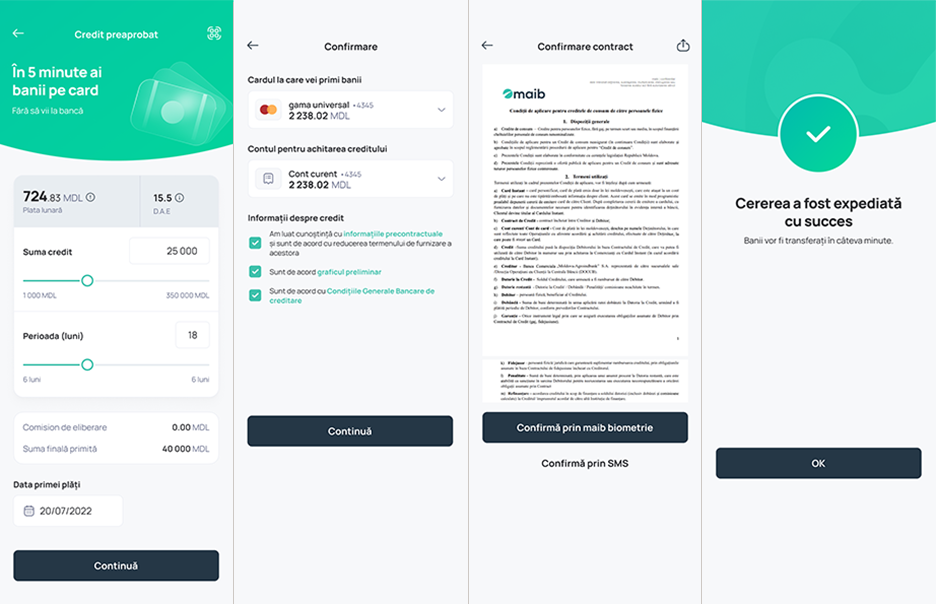

You can benefit from a pre-approved credit directly from the maibank application:

- open the application and check the available amount in the loan category;

- click on the "take the money" button;

- select the amount and the crediting period;

- click on the "receive money" button and follow the steps in the application.

Subscription to the credit offer:

- Go to the app menu at the bottom of the screen,

press the button "check which credit offer you can receive" - Subscribe for free to the "credit offer" service

- The offer will be available in the main menu shortly

Credit offer selection:

- Access the maibank app and click on the available credit offer.

- In a few moments you will receive the offer with the maximum amount available.

- Choose the amount you need and the loan repayment period.

- Choose the card you want to receive the money on.

- In a few minutes, the requested amount is transferred to the account.

take the first step

fill in the fields and we will contact you

- step 1 of 2 personal data

- step 2 of 2 OTP signing

sign with OTP

to confirm, enter the 6-digit code received via SMS to the number +373

Attention! Applications are processed Monday to Saturday. Monday-Friday 09:00-20:00 / Saturday 09:00-18:00