factoring corporate clients

about

Reverse Factoring is a financing solution for the Supplier initiated by the Buyer, a legal entity, a customer of the bank (the Borrower), used to provide early payments to its Supplier based on invoices resulting from the Commercial Contract. In Reverse Factoring, the buyer's creditworthiness is analysed, and its suppliers are financed on the basis of the invoices assigned to the bank.

Participants in Reverse Factoring operations:

- The borrower (supplier) - sells goods or services under a Commercial Contract with deferred payment terms;

- The debtor (buyer) - buys goods or services under a Commercial Contract with deferred payment terms;

- Factor (maib) - accepts assigned receivables and finances invoices.

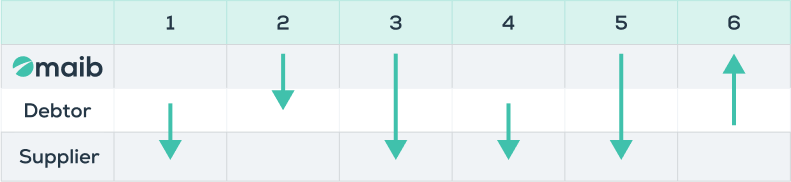

How does Reverse Factoring work?

- The Supplier delivers or will deliver the goods to the Debtor under the Commercial Contract with deferred payment terms;

- Maib approves the factoring limit on the Debtor and signs the Reverse Factoring Contract with the Debtor;

- Maib performs KYC for the Suppliers accepted by the Debtor. Sign the Factoring Contract with the Supplier;

- The Debtor accepts the Invoices issued by the Supplier, with the countersignature of the Invoice Borderer drawn up by the Adherent;

- Maib finances the invoices accepted and assigned to the Bank, included in the Invoice Draft. Payment of the factoring commission by the Supplier;

- The Debtor pays maib the invoice amount assigned to the bank when due.

benefits

what does the debtor gain?

developing a business relationship with the Supplier |

ensuring the continuity of the supply chain |

extending payment terms with its suppliers |

streamlining working capital that can be redirected to other initiatives for the development of the company |

what does the debtor gain?

developing a business relationship with the Debtor |

an alternative source of financing, allowing access to liquidity, but with no impact on the debt ratio |

efficient cash flow management. Suppliers collect 100% of the value of invoices before the due date for a fee paid to the bank |

ensuring business continuity |

requirements

Reverse Factoring is offered to maib's corporate customers:

- who have been in business for at least 12 months in pre-production, distribution, trade and services;

- who purchase goods or receive services based on tax invoices on the territory of the Republic of Moldova with deferred payment terms (up to 180 days);

- the cooperation relationship between the seller and the buyer has a contractual basis in which the conditions of delivery/performance of goods/services, payment terms, etc. are stipulated.

Tax invoices will be accepted for financing:

- with a nominal value of more than 50 000 MDL;

- with a collection period of at least 20 days and not exceeding 180 days.

reverse factoring commission

rates

In Reverse Factoring operations, a factoring commission is applied. It is charged in full on the date of financing for each invoice and paid by the Supplier (Borrower).

frequent questions

It is a financing solution for the Supplier, based on the creditworthiness of the Buyer - legal entity, customer of the bank (Debtor), whereby the receivables resulting from the delivery of goods or services, materialised by tax invoices, are assigned to the bank. For each invoice accepted by the Debtor and maib, the Debtor undertakes an unconditional and irrevocable payment commitment towards maib, and the Supplier, based on the assignment of the receivable, benefits from an advance collection for 100% of the amount accepted for payment of the invoice, based on a factoring commission paid to the bank.

Reverse Factoring is initiated by the Debtor-Purchaser in a commercial relationship.

Maib corporate customers - Buyers in a commercial relationship with a considerable and fragmented supplier portfolio.

No. Reverse Factoring is an alternative source of financing for the Supplier, which allows access to liquidity, but has no impact on the Supplier's indebtedness.

Suppliers receive 100% of the invoice value before the due date for a fee paid to the bank.

The Debtor, with whom maib signs the Reverse Factoring Agreement, determines the Suppliers proposed to the bank for Reverse Factoring operations. Once the relationship with the bank has been initiated/updated by maib and the Factoring Contract has been signed with the Suppliers accepted by the Debtors, Reverse Factoring operations can be initiated.

In Reverse Factoring operations, the Factoring Commission is applied to the amount financed depending on the financing period. The factoring commission is paid by the Provider.

The Debtor will pay a Late Payment Interest only if the financed amount of the assigned invoice is not paid when due.

get details about Reverse Factoring

enter your data and we will contact you

maibank

maibank

maib business app

maib business app

internet banking - individuals

internet banking - individuals

new internet banking - maib business

new internet banking - maib business

internet Banking - BankFlex

internet Banking - BankFlex