salary card maib

about

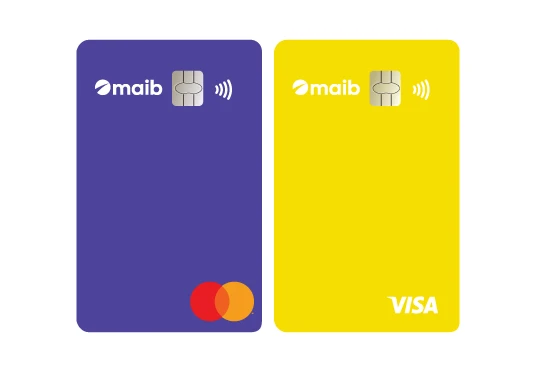

The salary card is issued in three salary packages. Depending on the card package Visa Classic or Mastercard Gold can be issued together with another free card account:

- Salary Daily – Visa Classic* or Mastercard Gold;

- Salary Loyalty - Visa Classic/Mastercard Gold and gama universal;

- Salary Premium - Visa Classic/Mastercard Gold and gama premium.

The Salary Loyalty and Salary Premium packages will allow you to benefit from all the advantages and special offers dedicated to premium cards: gama universal and gama premium both in the Republic of Moldova and abroad.

The Salary Loyalty package is ideal for collecting salaries and making daily payments. It contains a set of free services suitable for fast and safe payments.

The Salary Premium package is suitable for middle and top management companies, including IT companies.

The cards included in the salary packages are issued free of charge, for which the salary fees and commissions are applied.

*Salary card for public sector/budget organization employees to receive salaries through MPay/employees not participating in maib salary projects who wish to receive salary transfers to their maib card.

Payment system

|

Destination

|

Free supplying in maib

|

Free access to digital services through maibank

|

Free supplying of the card through other banks in the Republic of Moldova

|

Free card opening and servicing

|

Discover the discounts offered by maib and partners:

|

Pleasant shopping and convenient installments

|

commission fees

| Card servicing |

Free |

| Issuance / re-issuance of the card |

Free issuing and re-issuing upon expiration 40 MDL for re-issuance in other cases (loss/theft/compromise/other cases) |

| Payments at commercial points |

Free |

| Supplying the card in maib |

Free

|

| Supplying the card through other banks |

|

| Cash withdrawal in maib |

|

| Cash withdrawal in other banksCash withdrawal in other banks |

1%+30 MDL/1.5 EUR/USD

1.5%+60 MDL/3 EUR/USD

|

| P2P transfer on the card of other banks |

10 MDL / 0.5 EUR/USD

1.5% min 30 MDL/1.5 EUR/USD

|

| Free information and online services |

Free

15 MDL

|

More details on Fees and commissions here

required documents

To obtain the Visa Classic/Mastercard Gold card, you only need the identity document.

*The bank reserves the right to request supporting documents regarding your income to meet the prudence requirements of banking activity.

General banking conditions for individuals within BC "MAIB" SA here

frequent questions

3D Secure is a service attached to your card, ensuring worry-free online shopping and an advanced anti-fraud solution. 3D Secure technology emerged as a response to the need to develop means to verify if the person making a payment on the Internet is the real holder of the card. Thus, when making a transaction online, in addition to the required standard data (card number, validity date and CVV2/CVC2 code), a unique password sent to the cardholder via SMS to the phone number registered in the banking system is also used. 3D Secure technology applies only to merchants who have displayed one of the Visa Secure, or Mastercard ID Check logos on their website, which confirms that they are certified to use the technology by international card payment systems.

The card is issued for 3 working days from the submission of the request.

In case of loss or theft of the card, it is urgently necessary to block the account through the maibank mobile app or by calling the Self Service service 1313. Likewise, you can contact us at the phone number /+373 22/ 45 06 03, indicated on the back of the card, both from the country and abroad.

maibank

maibank

maib business app

maib business app

internet banking - individuals

internet banking - individuals

new internet banking - maib business

new internet banking - maib business

internet Banking - BankFlex

internet Banking - BankFlex